Explore Options

Unlock your home’s

hidden equity:

HECM

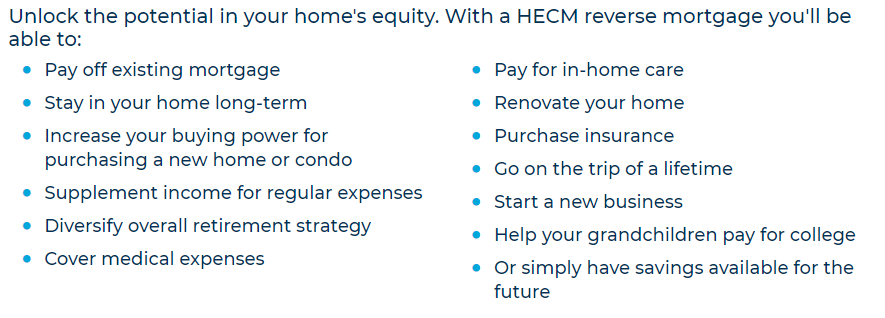

A HECM gives you the power to unlock the equity

built up in your home while you continue to live in

it. With additional funds freed up you can lower

your expenses, do renovations, take off on a trip or

simply have funds available for when you need

them.

It is a loan that converts your home equity into cash. The unique benefit is that you don’t need to pay it back month after month. Interest and fees are added to the loan balance over time.

Borrowers must continue to pay taxes and insurance as always while upholding the terms of the loan.

Live your retirement dreams now that your biggest asset is working for you.

The loan is payable at the time you leave the home, and it is a non-recourse loan which means you or your estate cannot owe more than the value of the property.

Frequently Asked Questions

Still not sure about something? Click below to get quick answers on some of our most frequently asked questions.

How does HECM work?

- The amount of loan proceeds is determined by age of borrower and appraised value of home.

- Financial Assessment to determine long-term ability to pay taxes and insurance

- Independent counseling

- Formal Appraisal

- Proceeds pay off your current mortgage.

- Cash can be a lump sum and you can get the remainder as installment payments or a line of credit. The unused portion will grow every month providing a significant cushion for the future.

- Continue to pay your taxes and insurance and to uphold the terms of the loan.

- With room in your budget after eliminating mortgage payments, and with cash in hand or a growing line of credit, create a retirement you feel good about.

What is a reverse mortgage?

A reverse mortgage is a loan that enables homeowners and homebuyers age 62 or older to convert some of their home equity into cash or a line of credit. Some loans also let homeowners finance a new home purchase. With a reverse mortgage, you make no loan payments†. You continue to live in and own your home.

Unlike a traditional home equity loan or home equity line of credit (HELOC), you don’t have to repay a reverse mortgage until the home is sold** or the last surviving borrower (or a non-borrowing spouse who meets certain requirements) no longer lives in the home. The homeowners must maintain the condition of the home and stay current with property taxes and hazard insurance.

Am I eligible?

To be eligible for a reverse mortgage, you must meet the following criteria:

- You must be age 62 or older.

- The home must be the borrowers’ primary residence.

- The home must meet Federal Housing Authority (FHA) minimum property standards and flood requirements.

- The home must be one of the following property types: single-family home; a two- to four-unit home with one unit occupied by the borrower; or a HUD-approved condominium. With new construction, you must have a Certificate of Occupancy or equivalent before you apply.

- You must have sufficient home equity. A Reverse Mortgage Specialist from Finance of America Reverse LLC (SoCal REVERSE) can tell you if you have enough home equity to qualify.

How much money can I get?

You may receive a portion of your home equity. How much depends on a number of factors, including the age of the youngest borrower or non-borrowing spouse, your home value, the amount of equity, FHA lending limits, the current interest rate, and the reverse mortgage product and payment option you choose. An FAR Reverse Mortgage Specialist can give you a free quote that’s tailored to your specific situation.

You may receive a portion of your home equity. How much depends on a number of factors, including the age of the youngest borrower or non-borrowing spouse, your home value, the amount of equity, FHA lending limits, the current interest rate, and the reverse mortgage product and payment option you choose. An SoCal Reverse Mortgage Specialist can give you a free quote that’s tailored to your specific situation.

I WANT TO KEEP UP TO DATE ON

RETIREMENT TRENDS

[wpforms id=”689″]